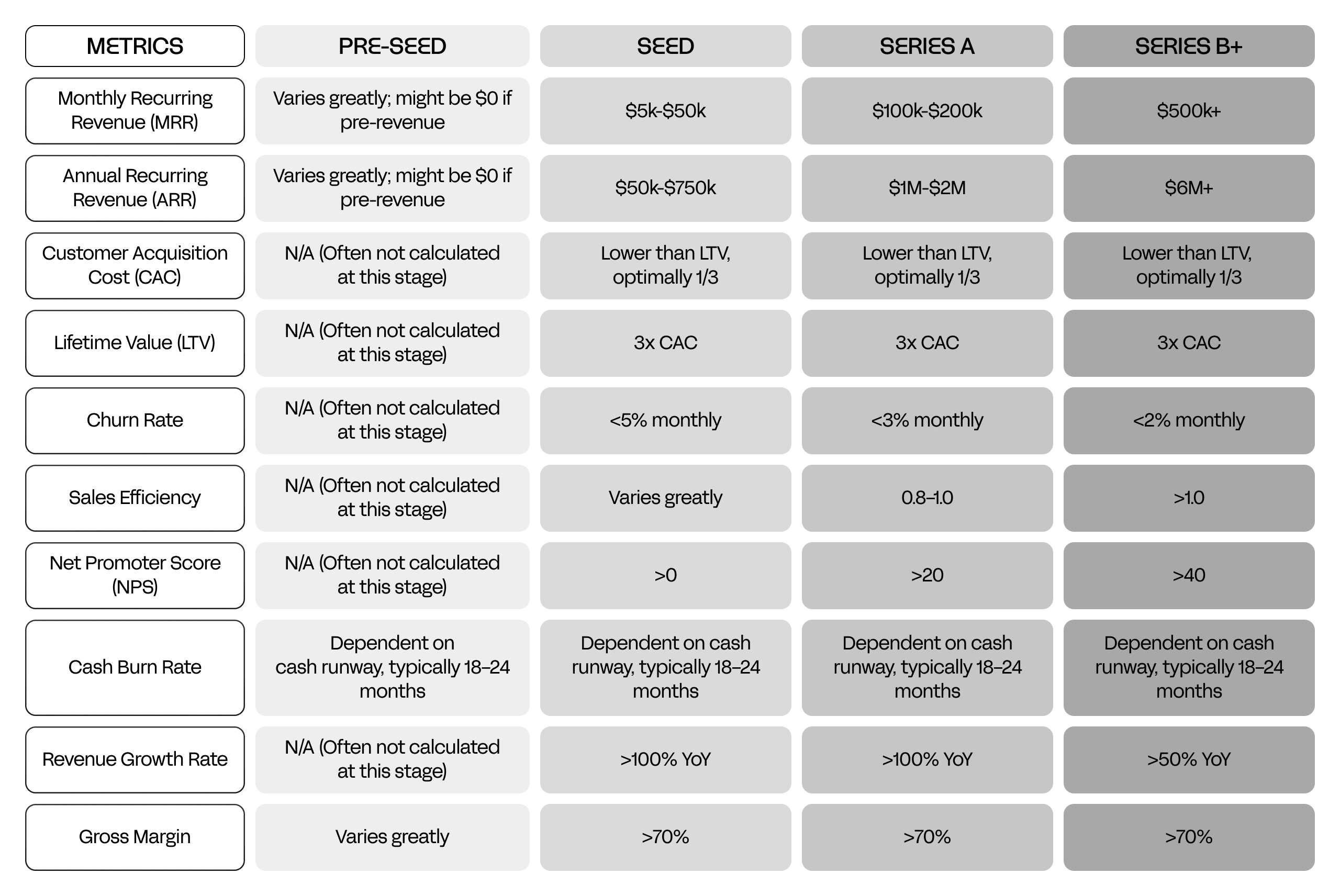

Essential B2B SaaS Metrics Every Startup Founder Must Track

For many first-time startup founders, it’s easy to get caught up in building the product and forget to measure its performance. But in the world of B2B SaaS, knowing your numbers isn’t just helpful—it’s essential.

Tracking key SaaS metrics offers two huge advantages: operational insight and investor readiness. Metrics don’t just show how well your startup is doing—they give you the ammunition to prove your value to potential investors.

So, whether you're optimizing your growth engine or preparing for your next funding round, here are the most critical B2B SaaS metrics you need to understand, calculate, and monitor consistently.

1. Recurring Revenue: MRR & ARR

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) are the backbone of any SaaS model. These metrics help you forecast revenue predictably and show investors that you’ve built a scalable business.

👉 Monthly Recurring Revenue (MRR)

This is the total predictable revenue a company expects to earn every month from active subscriptions.

Example: If you have 100 customers each paying $50/month, your MRR is:

100 x $50 = $5,000 MRR

👉 Annual Recurring Revenue (ARR)

This is simply your MRR multiplied by 12. It shows how much revenue you're projected to earn over a year if nothing changes.

Formula: ARR = MRR x 12

Example: $5,000 x 12 = $60,000 ARR

👉 Why They Matter?

- Forecasting: They allow businesses to predict future revenue with a high degree of accuracy.

- Investor Confidence: Investors love recurring revenue because it shows stability and scalability.

- Growth Indicator: If your MRR and ARR are increasing, it’s a strong sign that:

- People want your product (product-market fit).

- Customers are sticking around (good retention).

💡 Growth in these numbers signals product-market fit and strong customer retention.

2. LTV:CAC Ratio

This ratio tells you how much value each customer brings compared to what it costs to acquire them.

👉 Lifetime Value (LTV)

Formula: LTV = ARPU x Gross Margin % x Avg Customer Lifespan

where, ARPU = Average Revenue Per User

Example: LTV = $100 x 0.8 x 12 = $960 LTV

where,

• ARPU = $100/month,

• Gross Margin = 80% (0.8) &

• Average Customer Lifespan = 12 months

👉 Customer Acquisition Cost (CAC)

Formula: CAC = Total Sales & Marketing Spend / New Customers Acquired

Example: CAC = $9,600 / 100 = $96 CAC

where,

• Total Sales & Marketing Spend = $9,600 &

• New Customers Acquired = 100

👉 LTV:CAC Ratio

Calculation: LTV:CAC Ratio = $960 / $96 = 10:1

This means for every $1 spent on acquiring a customer, you're making $10 over their lifetime—a very healthy ratio.

👉 What’s a Good LTV:CAC Ratio?

- ✅ 3:1 or higher = Healthy and sustainable

- ❌ 1:1 or lower = You're losing money on customer acquisition

3. Churn Rate

Churn Rate measures how many customers cancel their subscriptions over a period of time. Keeping churn low is crucial for long-term growth in any subscription-based business.

Formula: Churn Rate = (Customers Lost / Customers at Start of Period) x 100

Example: Churn Rate = (60 / 1,000) x 100 = 6% Churn Rate

where,

• Customers at the start of the month: 1,000 &

• Customers lost during the month: 60

👉 Why It Matters?

- A high churn rate means you're losing customers faster than you can acquire them.

- Reducing churn helps boost revenue, improve customer lifetime value, and grow sustainably.

- Warning sign: A churn rate above 5–7% monthly is usually considered too high.

4. Net Revenue Retention (NRR)

NRR shows how much revenue you retain and grow from your existing customers after factoring in churn, upgrades (upsells), and downgrades.

Formula: NRR = (MRR at End of Period from Existing Customers / MRR at Start of Period) x 100

Example: NRR = ($55,000 / $50,000) x 100 = 110%

where,

• MRR at start of month from existing customers: $50,000

• MRR lost from churn/downgrades: -$5,000

• MRR gained from upsells: +$10,000

• MRR at end of month: $55,000

👉 Why It Matters?

- NRR tells you how much your existing customer base is growing or shrinking in value.

- 100%+ NRR means you're growing revenue even without acquiring new customers.

- Top-performing SaaS companies often aim for 110%–130%+ NRR.

5. Sales Efficiency

This shows how well your sales and marketing spend translates into new revenue.

Formula: Sales Efficiency = (Revenue This Quarter - Revenue Last Quarter) / Last Quarter’s Sales & Marketing Spend

Example: ($300,000 - $200,000) / $80,000 = 1.25

where,

• Revenue This Quarter = $300,000

• Revenue Last Quarter = $200,000

• Sales & Marketing Spend = $80,000

👉 Why It Matters?

- A ratio of 1 or more means your sales engine is efficient and scalable.

- It helps evaluate the ROI on your go-to-market spend.

6. Payback Period

This measures how long it takes to recover your customer acquisition costs.

Formula: Payback Period (months) = CAC / (MRR per Customer x Gross Margin %)

Example: $1,200 / ($100 x 0.8) = 15 months

where,

• CAC = $1,200

• MRR per Customer = $100

• Gross Margin = 80% (0.8)

👉 Why It Matters?

- A shorter payback period means quicker returns on your acquisition spend.

- Under 12 months is typically ideal for SaaS businesses.

7. Net Promoter Score (NPS)

NPS gauges customer satisfaction and loyalty by asking: “How likely are you to recommend us?”

Formula: NPS = % Promoters – % Detractors

Example: NPS = 70% - 10% = 60

where,

• Promoters = customers who rate 9 or 10

• Detractors = customers who rate 6 or below

👉 Why It Matters?

- A high NPS means customers love your product and are likely to refer others.

- NPS above 50 is excellent and supports word-of-mouth growth.

8. Cash Burn Rate

This tells you how fast you're spending your cash reserves.

Formula: Burn Rate = Net Cash Outflow / Time Period

Example: $120,000 / 3 months = $40,000/month

where,

• Net Cash Outflow = $120,000

• Time Period = 3 months

👉 Why It Matters?

- Helps you manage cash runway and control expenses.

- Essential for timing your next funding round.

9. Revenue Growth Rate

Growth is the lifeblood of any startup.

Formula: Revenue Growth Rate = ((Current Revenue - Past Revenue) / Past Revenue) x 100

Example: (120,000 - 100,000) / 100,000 x 100 = 20%

where,

• Current Revenue = $120,000

• Past Revenue = $100,000

👉 Why It Matters?

- Consistent growth proves traction and product demand.

- Important for attracting investors and scaling your team.

10. Gross Margin

Gross Margin reflects the profitability of your core service delivery.

Formula: Gross Margin = ((Total Revenue – COGS) / Total Revenue) x 100

Example: (100,000 – 25,000) / 100,000 x 100 = 75%

where,

• Total Revenue = $100,000

• COGS (Cost of Goods Sold) = $25,000

👉 Why It Matters?

- High gross margin means more room to invest in growth.

- In SaaS, a Gross Margin above 70% is considered strong and shows scalability.

Final Thoughts

Successful B2B SaaS founders don’t just track metrics—they act on them strategically. These numbers aren’t just for investors; they guide your decisions, highlight what’s working (or not), and ultimately fuel your company’s growth.

Startups that measure, analyze, and optimize these metrics early position themselves not just for survival, but for scale and investment.